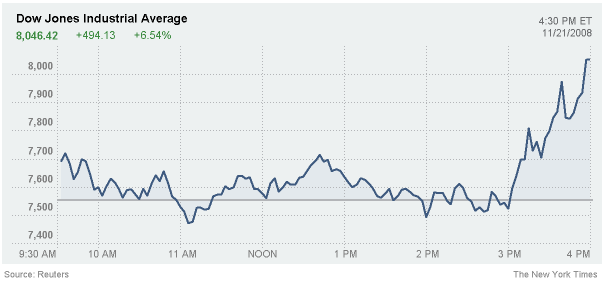

Dow Jones on the day of the Tim Geithner announcement

Wall Street rebounded from two straight days of triple digit losses on the news of President-elect Barack Obama's selection of Timothy F. Geithner, the president of the New York Federal Reserve, to be secretary of the Treasury.

Geithner is not a politician and has worked in the monetary area for all of his career, but has not been a typical Wall Street broker or marketer. Geithner began working with the Treasury Department in 1988 in the International Affairs division. In 1999 he became under secretary of the treasury for international affairs. He has close connections to the centrist Democratic policies of former President Bill Clinton and his best-known Treasury secretary, former Wall Street executive Robert E. Rubin. Mr. Geithner served under Mr. Rubin and Mr. Summers at Treasury in the 1990s, and rose to be undersecretary for international affairs. His chief rival for the Treasury secretary was his former boss at Treasury, Lawrence H. Summers, President Bill Clinton’s final Treasury secretary.

Geithner is not a politician and has worked in the monetary area for all of his career, but has not been a typical Wall Street broker or marketer. Geithner began working with the Treasury Department in 1988 in the International Affairs division. In 1999 he became under secretary of the treasury for international affairs. He has close connections to the centrist Democratic policies of former President Bill Clinton and his best-known Treasury secretary, former Wall Street executive Robert E. Rubin. Mr. Geithner served under Mr. Rubin and Mr. Summers at Treasury in the 1990s, and rose to be undersecretary for international affairs. His chief rival for the Treasury secretary was his former boss at Treasury, Lawrence H. Summers, President Bill Clinton’s final Treasury secretary.All interviews show that Geithner is not only well respected, but also well liked by his peers.

As Treasury secretary, Geithner would be charged with restoring stability to the financial markets, the banking system and the housing sector through oversight of the controversial $700 billion financial rescue package, of which about half is still available for use at the discretion of the Treasury secretary. He would also be chief overseer of the international push to reform the regulatory regime for the financial system, which, like a sputtering lemon on the autobahn, has been severely outrun by 21st century developments in financial practices and products.

His overarching task: Ensure that what happened to world markets and economies in the fall of 2008 never happens again.

~ ~ ~

Skittish financial markets closed dramatically higher following the reports, recouping some of the slide that brought them to 11-year lows. The Dow Jones industrial average soared 494.13 points or 6.5 percent, closing at 8,046.42. The broader Standard & Poor’s 500-stock index swung 6.3 percent higher, or 47.59 points to 800.03. The Nasdaq composite was up 5.2 percent.

No major economic reports, which have jolted markets all week, were released on Friday, and the Congressional lame-duck session paused as automakers retooled their case for a bailout. Early Friday, President Bush signed an extension of jobless benefits, which provides an additional three months for those whose unemployment benefits have run out or are about to expire.

Earlier this week, Wall Street slid to its lowest point in 11 years after two days of fevered sell-offs effectively erased all the gains of the Internet and housing booms. The Dow closed near 7,500 points on Thursday, and the S.&P. was lower than any point since 1997.

~ ~ ~

plez sez: OBAMA's cabinet is certainly taking shape... and for one, plezWorld likes what i see! the same calm, deliberative, analytical process that propelled Obama to the white house is evident in his cabinet choices. america is in good hands with Obama at the helm.

i am troubled by the lack of direction and leadership we are receiving from the lamest of lame duck presidents (bush) and his antagonists over in congress. it appears that they are hell-bent with doing NOTHING until their term is up! nothing has come out of washington since halloween... maybe congress and the president should forfeit 2 months of paychecks, since they haven't done *ISH*.

the economy continues to slip, they allow a public relations nightmare by hosting a group of money grubbing, private jet flying auto makers for one day... and then offer no solutions to the auto makers' crisis, even though over 10 percent of the jobs in the US are tied to the auto industry! this is quite disturbing that Obama is going to be handed a country that is fighting two wars and is in the midst of a crippling economic meltdown (the dow jones slipped below 8,000 points on thursday for the first time in over 2 years).

why let something as minor as the us constitution that bush has ignored for the past 8 years stop him, my suggestion is that george w. bush (and his cronies) should vacate the white house on december 1st and let BARACK OBAMA get a 8 week jump on getting this country back on track!

~ ~ Citations ~ ~

Read the New York Times article about Obama's selection of Timothy Geithner for Treasury.

Read the New York Times article about the Dow Jones reaction to the Geithner news.

Read the Bloomberg.com article about Timothy Geithner tapped for Treasury.

Read the CNN Money article about Timothy Geithner.

Read the CNN.com article about Obama's selection of Geithner for Treasury.

~ ~ ~ ~ ~ ~

2 comments:

It is difficult to comprehend the highly euphoric reaction on the Wall Street to the news that Timothy Geithner may be the Treasury Secretary in the Obama administration. It is being conveniently overlooked that he is one of those occupying key positions in the financial world who were in deep slumber while the disastrous fire which is presently engulfing the global financial system was smouldering, exhibited no inkling of any premonition of what was about to happen and never sounded even a hint of a warning of the impending firestorm. Geithner's culpability in this regard is all the more pernicious for the reason that he has been the President of the New York Federal Reserve located at the acknowledged financial capital of the world, has been at the epicenter where all the toxic derivatives cocktail was blended and cooked under his very nose and also has been a member of the FOMC. To hail his appointment as though he is the Messiah descending from Heaven who will save the world from the financial turmoil and economic meltdown is nothing more than wishful thinking and only gives credence to the long-suspected possibility that the Wall Street is populated by denizens with extremely low IQ levels!

I hope he delivers big time!!

Post a Comment